Married Couple Health Insurance

Simran has over 4 years of experience in content marketing, insurance, and healthcare sectors. Her motto is to make health and term insurance simple for our readers has proven to make insurance lingos simple and easy to understand by our readers.

Reviewed By:

Anchita has over 6 years of experience in content marketing, insurance, and healthcare sectors. Her motto to make health and term insurance simple for our readers has proven to make insurance lingos simple and easy to understand by our readers.

Updated on Jul 14, 2025 5 min read

The Overview: Best Health Insurance Plan For Married Couple

Marriage is something where two families come together to form a new union for life. It is a turning point in a person’s life, the moment when two people start sharing their lives, home, future plans, highs and lows.

Today married couple do not just share their home and life but also take major life decisions that makes their future more bright and prosperous. They need to look out for each other’s physical and mental well-being. One of these many major life decisions includes buying a health insurance plan that covers both partners. Many health insurance companies in India cater to these newly married couples by providing some of the best health insurance plans. These health policies provide comprehensive coverage for the needs of the partners including pre and post-hospitalisation, OPD benefits, maternity and newborn care, etc.

To know in detail about the best health insurance plan for married couples, read on.

Key Takeaways

- Evaluate your and your partner’s health history, family planning goals, and potential lifestyle changes to ensure adequate coverage.

- Understand how the plan handles pre-existing conditions and any potential waiting periods or exclusions for you and your partner.

- Consider portability if you or your partner may change jobs.

Top Health Insurance Plans for Married Couples

| Plan Name | Entry Age | Sum Insured |

|---|---|---|

| Niva Bupa Aspire | 18 years | Upto Rs 1 Crore |

| Star Women Care | 18 years | Upto Rs 1 Crore |

| Care Joy | 18 years | Upto Rs 5 Lakhs |

| ICICI Lombard Health AdvantEdge | 18 years | Upto Rs 3 Crores |

| ManipalCigna ProHealth Prime Advantage | 18 years | Upto Rs 1 Crore |

| Aditya Birla Activ Health Platinum Enhanced | 91 days | Upto Rs 2 Crores |

Why Newly Married Couples Should Get Health Insurance?

A health insurance plan is a crucial investment for the newly married couple. Yeah heard that, right! Here is why!

Unpredictable Health Challenges

You never know when an unforeseen health challenge comes up in your way. A comprehensive health insurance plan can help you cover the cost of treatments, medications, hospital stays and other medical care requirements during difficult times.Managing Parenthood

A health cover will help you manage the medical expenses that can come up with your child till they turn 25 years old. Also, maternity and newborn care can be expensive, so you need a good health insurance plan that can cover these costs.Shared Financial Responsibilities

As a married couple, you share financial responsibilities. Good health insurance can protect both of you and your joint finances from the sad impact of unexpected medical expenses.Covers Pre-existing Conditions

If either of you has pre-existing health conditions, a health insurance plan can provide coverage for treatments and medications, ensuring you have access to necessary care. You just need to be sure which plan is best for you. POV- By investing in a comprehensive health insurance plan, newly married couples can protect their financial well-being and ensure they have the resources to cope with unexpected medical challenges.

Types Of Health Insurance Plans For Newly Married Couples

Several kinds of health insurance plans are suitable for you and your partner.

Family Health Insurance Plan

One of the best types of health insurance plans for a married couple. It gives more sum insured at the same premium.Critical Illness Health Insurance

These types of plans provide coverage against any critical illness such as cancer, heart attack, kidney failure, and many more.Group Health Insurance Plan

Group Health Insurance plans are offered by the employers to their employees. Sometimes, these plans cover your spouses and children too.Top-up Health Plan

These plans provide additional coverage above your existing health insurance policy. Top-up and super top-up plans add an extra sum insured above your base health insurance coverage to secure you against expensive medical treatments.

Factors To Consider While Buying Newly Married Couple Health Plans

- Health History Evaluate your and your partner’s health history, including any pre-existing conditions.

- Family Planning: If you plan to have children, ensure the plan covers maternity and newborn care.

- Lifestyle: Consider your lifestyle and any potential health risks associated with it. For example, if you are a regular smoker, then you need to choose plans that cover smokers too.

- Adequate Coverage: Choose a plan with a sum insured that is sufficient to cover potential medical expenses. Like, if you are planning a baby, then you should get a plan that covers new born baby too.

- Future Needs: Consider your future plans, such as starting a family or relocating, and adjust the sum insured accordingly.

- Accessibility: Ensure the plan has a wide network of hospitals in your area for convenience.

- Preferred Hospitals: If you have specific hospital preferences, check if they are included under the network hospital list of your preferred health insurer..

- Coverage: Understand how the plan handles pre-existing conditions. Some plans may have waiting periods or exclusions for pre-existing conditions such as diabetes, hypertension, etc.

- Maternity and Newborn Care: If you plan to have children, consider adding maternity and newborn care coverage.

- Critical Illness Coverage: Protect yourself against major illnesses with critical illness coverage.

- Personal Accident Coverage: Consider personal accident coverage for financial protection in case of accidental injuries or death.

- Budget: Compare premiums from different insurers to find a plan that fits your budget.

- Value for Money: Consider the coverage offered versus the premium charged.

- Efficiency: Research the insurer’s reputation for timely and hassle-free claim settlements.

- Customer Reviews: Check online reviews and testimonials from other policyholders.

- Job Changes: If you or your partner may change jobs, ensure the plan is portable to avoid coverage gaps.

- Pre-existing Conditions: Be aware of any waiting periods for pre-existing conditions.

- Understand Exclusions: Carefully review the policy documents to understand any exclusions or limitations.

How Much Sum Insured In Health Insurance Is Needed For A Newly Married Couple?

There are several factors on your ideal sum insured while choosing a health insurance for a married couple. However, a decent sum insured of around ₹5-10 lakhs for a newly married couple without any major health concerns might be sufficient.

- Age: Younger couples may require a lower sum insured compared to older couples.

- Health History: If either partner has pre-existing health conditions, a higher sum insured may be necessary.

- Lifestyle: A more adventurous lifestyle might warrant a higher sum insured.

- Family Planning: If you plan to have children, consider the potential costs of maternity and newborn care.

- Geographic Location: Healthcare costs can vary by region. If you live in an area with higher medical expenses, a higher sum insured may be advisable.

FYI, a higher sum insured often comes with a higher premium. It’s important to balance the level of coverage with your budget and risk tolerance.

Where To Buy Health Insurance For Newly Married Couples?

Investing in a comprehensive health insurance plan is a wise decision for newly married couples. It provides financial protection against unexpected medical expenses, ensuring peace of mind and stability during challenging times. By carefully considering factors such as coverage needs, sum insured, network hospitals, and additional benefits, you can select a plan that aligns with your specific requirements and budget. Remember to review your policy regularly to ensure it remains adequate as your life circumstances change. With the right health insurance coverage, you can safeguard your future and enjoy a healthier, more secure married life.

To get the best advice on the best health insurance for married couples, you can always visit Policyx.com.

Consult for Personalized Insurance Advice

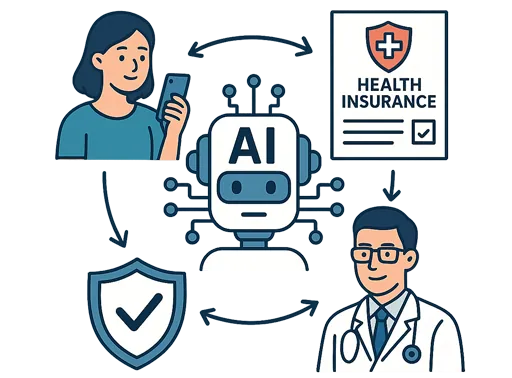

But how does it work?

Schedule a call with India’s number 1 trusted advisor with a 4.5+ rating on Google. We are not your average insurance agents. Our advisors are experts in their insurance knowledge and will give you the right information at the right time. The service is free of cost! Don’t worry, we won’t spam as we value your time.

Health Insurer Network Hospitals

Best Health Insurance Plan for Married Couple: FAQs

1. Is it necessary to get a joint health insurance plan as a newly married couple?

While a joint health insurance plan can be a cost-effective option, it’s not mandatory. Individual plans can also provide adequate coverage, especially if one partner has pre-existing conditions or specific health needs.

2. What is the difference between a health insurance plan and a critical illness plan?

A health insurance plan covers a wide range of medical expenses, while a critical illness plan specifically covers the costs associated with critical illnesses like cancer, heart problems, or kidney failure.

3. Can we claim maternity benefits under our health insurance plan?

Yes, most health insurance plans offer maternity benefits, but there may be waiting periods and specific conditions to meet.

4. What is a pre-existing condition, and how does it affect coverage?

A pre-existing condition is a health condition you had before purchasing the insurance. Some plans may have waiting periods or exclusions for pre-existing conditions.

5. Can we change our health insurance plan after getting married?

Yes, you can change your health insurance plan at any time. However, there may be waiting periods or exclusions for pre-existing conditions if you switch plans.

Health Insurance Companies

Know More About Health Insurance Companies

2864-1724827757.webp)

2212-1724829843.webp)